2025 Inherited Ira Rules - You’ve inherited an IRA. What happens next? CD Wealth Management, New rules for inherited iras could leave some heirs with a hefty tax bill. The dispute concerned secure act regulations that changed the. Successor Beneficiary RMDs After Inherited IRA Beneficiary Passes, Learn the required minimum distributions for your designated ira beneficiaries. Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death;

You’ve inherited an IRA. What happens next? CD Wealth Management, New rules for inherited iras could leave some heirs with a hefty tax bill. The dispute concerned secure act regulations that changed the.

/https://blogs-images.forbes.com/baldwin/files/2014/03/rmd_own_larger.png?resize=618%2C635&ssl=1)

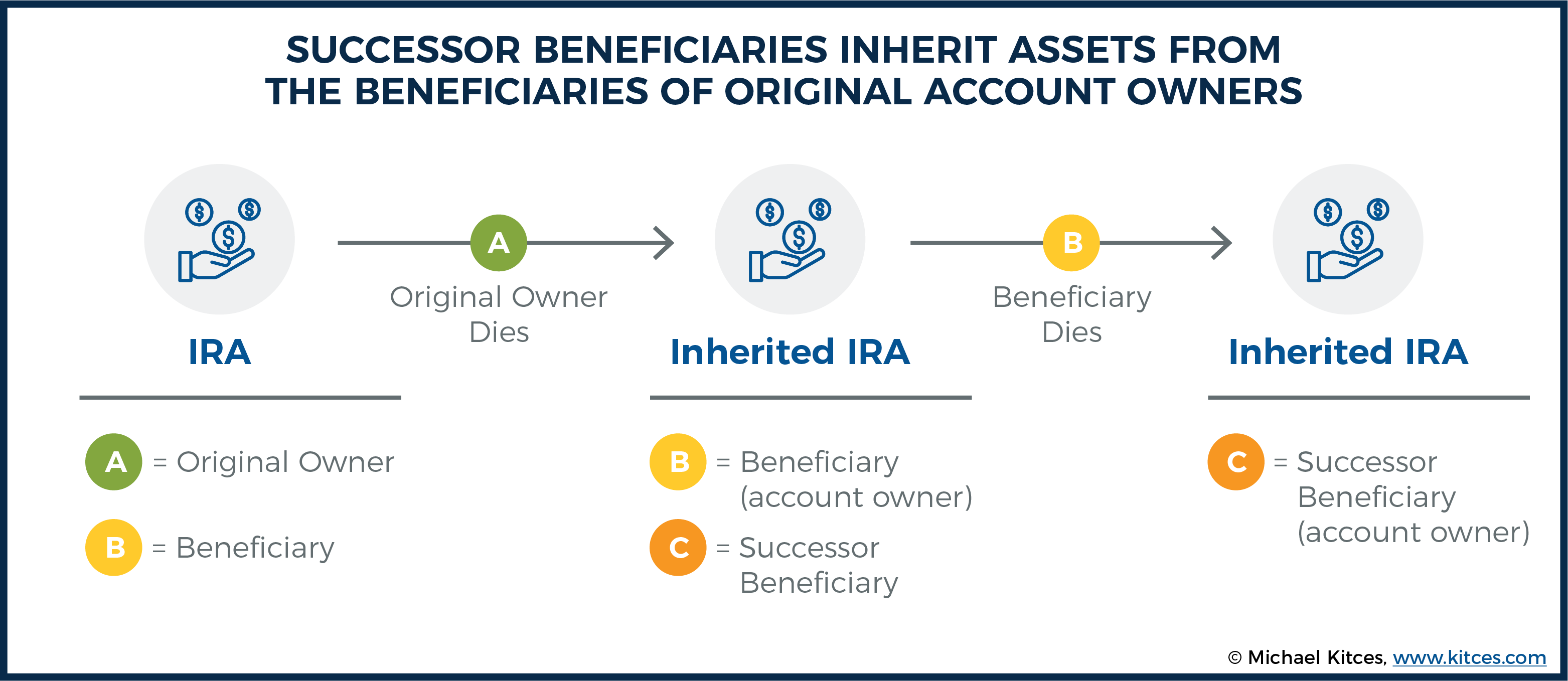

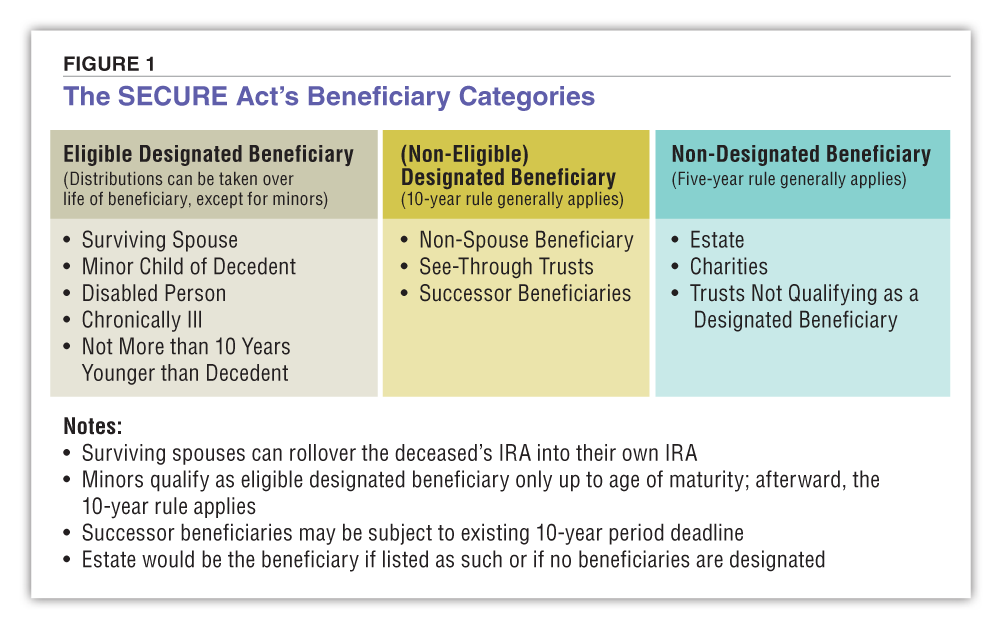

Successor Beneficiary RMDs After Inherited IRA Beneficiary Passes, Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death. Secure act rewrites the rules on stretch iras.

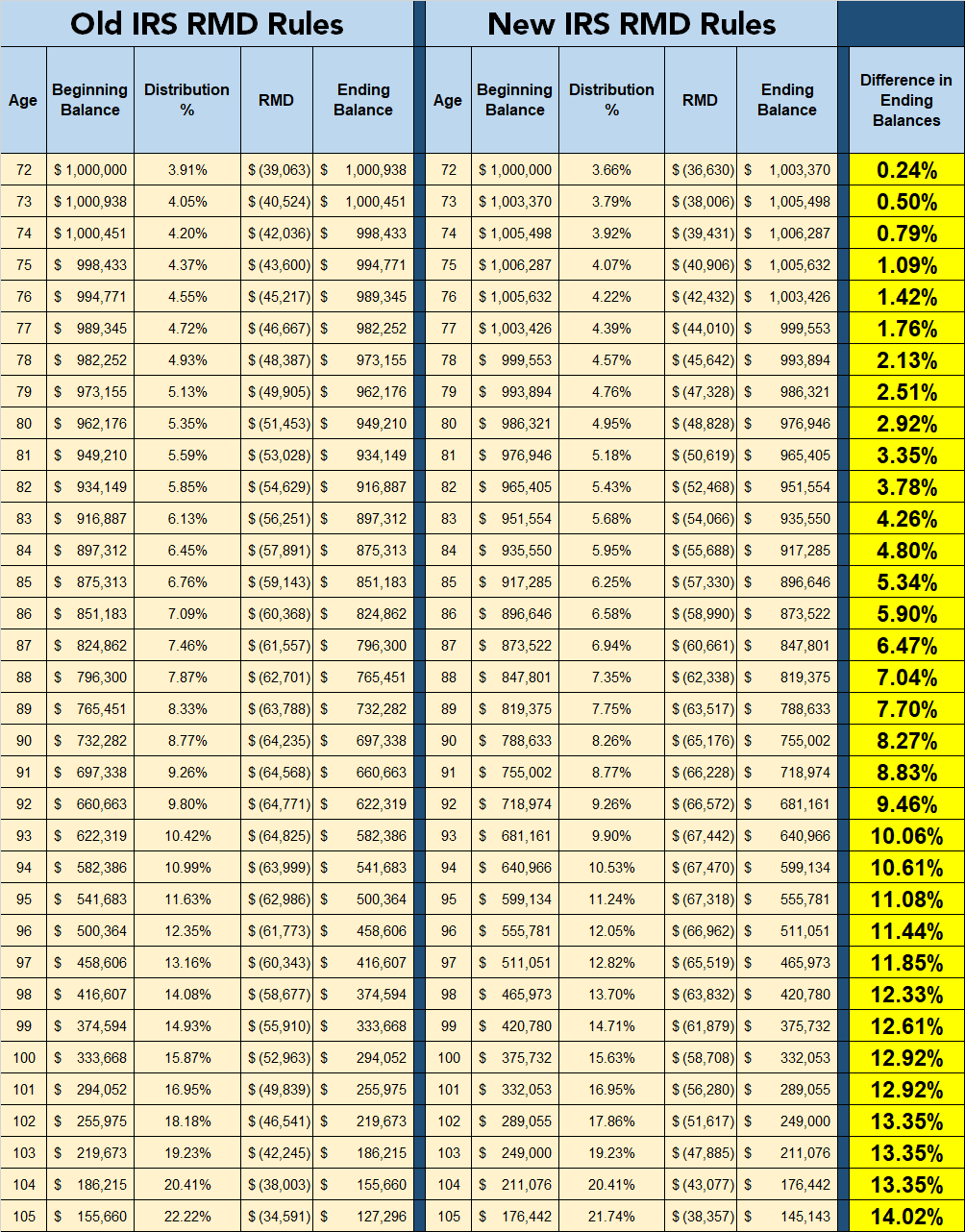

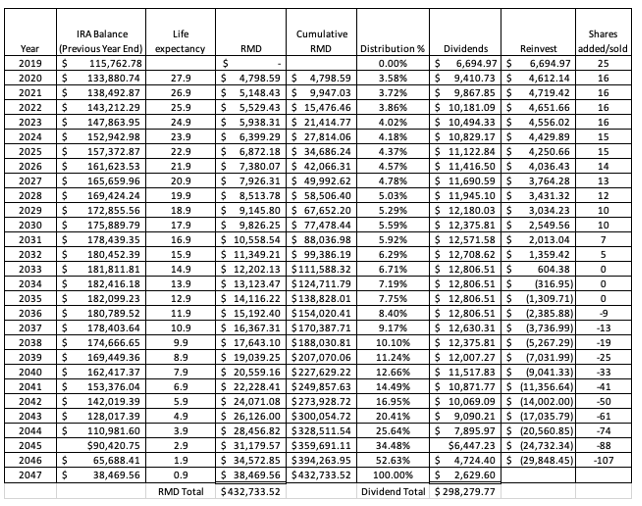

Inherited Ira Distribution Table 1, In the first quarter of 2023, americans held more. Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death;

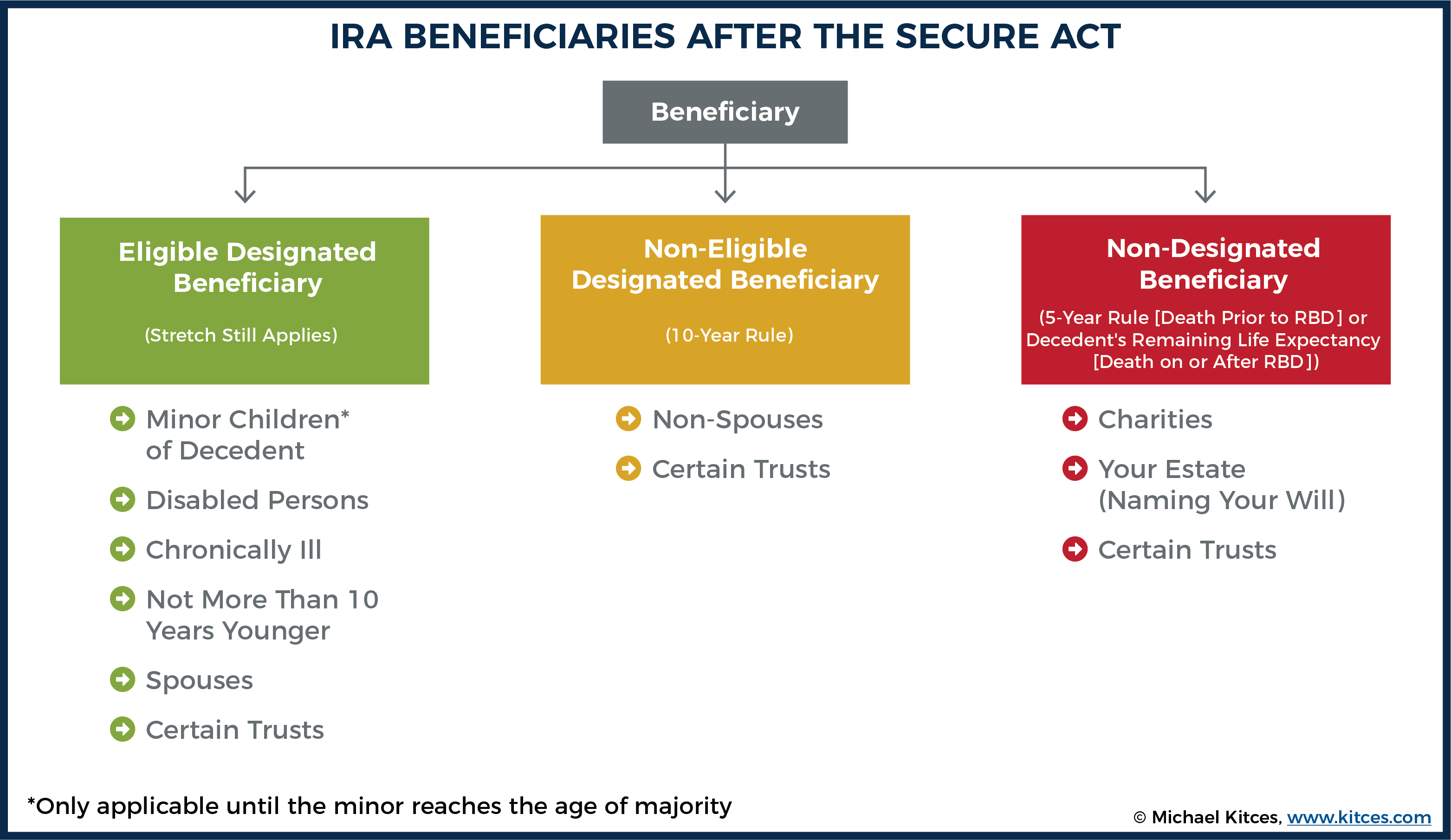

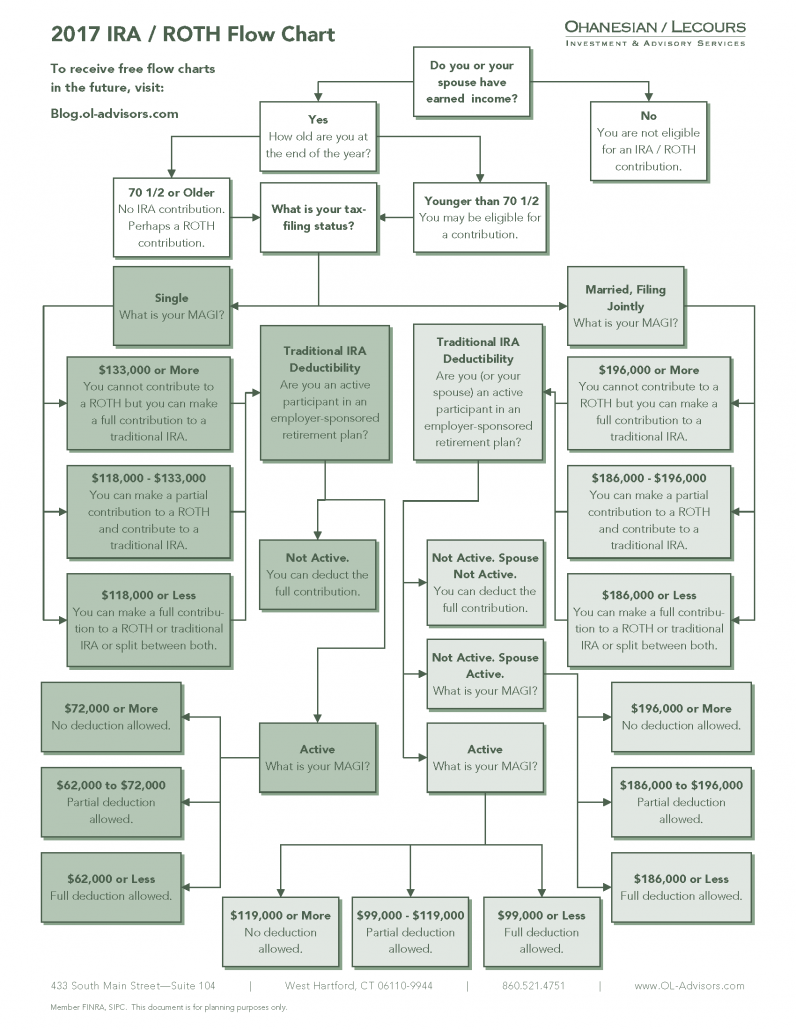

Visualizing IRA Rules Using Flowcharts, The inherited ira rules have undergone significant changes in 2025, especially following the introduction of the secure act. Consider new contributions there no longer is an age limit for making contributions to.

Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death.

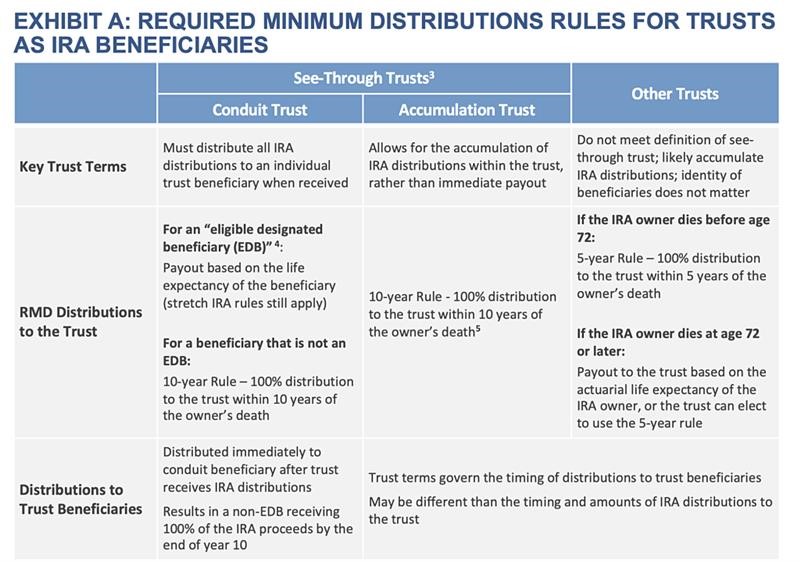

YearEnd Planning RMD & Inherited IRA Strategies Relative Value Partners, The rmd rules for inherited iras apply to both traditional and roth accounts. Because secure 1.0 creates a thicket of rules and classifications to wade through, the irs decided to waive missed rmd penalties for inherited iras from 2025.

Mens Shorts Styles 2025. The 2023 guide to men's shorts styles & fashion trends. The […]

The setting every community up for retirement enhancement (secure).

IRS Notice 202354 Provides Relief, Guidance Regarding RMDs, Best roth ira for mobile trading. The secure act requires most beneficiaries of an ira to begin drawing down their inherited account within ten years of the owner's death.

New rules for inherited iras could leave some heirs with a hefty tax bill.

Rmd Tables For Inherited Ira Tutorial Pics, Spousal transfer (treat as your own) option #2: If it's a traditional ira, your withdrawals will be.